As you embark on life's journey, imagine a future where financial worries fade away, and your dreams take center stage. Picture a life where your loved ones are secured, your passions are pursued, and your aspirations are within reach. A life where every milestone is a celebration, not a financial burden.

This is the gift of peace of mind that ICICI Pru Gift Select offers – a life insurance1 savings plan that support your goals at every step. It combines protection for your loved ones with a guaranteed income2 stream, which can help fund your golden years, life's big moments, or act as a safety net for unexpected twists.

With ICICI Pru Gift Select, you SELECT to live life on your own terms, with confidence.

2 T&C apply

What makes ICICI Pru Gift Select special?

- Leave behind a legacy with the safety of a life insurance cover1

- Secure an income stream with guaranteed2 payouts starting as early as first policy month

- Get rewarded instantly with an Instant Cashback benefit3 , paid out upon policy issuance

- Protect your savings against inflation with the option to receive guaranteed income2 that increases every year

- Boost your savings with the option to enhance your guaranteed income by choosing a lower life cover4

- Enjoy cashflow flexibilities such as accumulating income5 to withdraw later or withdrawing future income in advance as a lump sum6

- Optimise your tax savings as tax benefits7 may be applicable on premiums paid and benefits received as per the prevailing tax laws

Benefits in detail

You pay premiums for a specific period (known as the premium payment term). During this period, you will receive guaranteed2 regular income known as Guaranteed Income (GI)2 starting from your chosen income start date and continuing till the end of the policy term. This ensures financial stability for you and your loved ones.

1. Instant Cashback Benefit3

In today’s fast-paced world, we are wired to appreciate immediate rewards. This feature caters to the innate desire for instant gratification by providing an instant cashback benefit. This allows you to enjoy the benefits of your policy without delay.

You can opt to receive instant cashback benefit only at policy inception. If you have opted for this, you will receive this benefit amount within one working day of realisation of the first year’s premium by the company, post policy issuance.

2. Guaranteed Income Benefit2

This plan provides a steady income stream, helping you meet your financial obligations and achieve your long-term goals, regardless of market fluctuations or unexpected events.

You will receive a level guaranteed income (GI)8 from the chosen GI start date until the end of the policy term, provided all due premiums are paid and on the survival of the Life Assured on the respective GI due dates.

We understand you may also want your income to keep pace with rising costs, thereby maintaining your current lifestyle. Hence, to plan your expenses better, we also offer you the option to receive an increasing guaranteed income8.

If you choose to receive income that increases every year, your guaranteed income will increase every year at a rate of 5% p.a. on a compounding basis.

3. Maturity Benefit9

You have the option to receive a proportion of the total premiums paid during the premium payment term, as a lump sum benefit upon policy maturity. You must select this benefit at the time of policy inception.

Let us take an example to understand how ICICI Pru GIFT Select works:

Illustration 1:

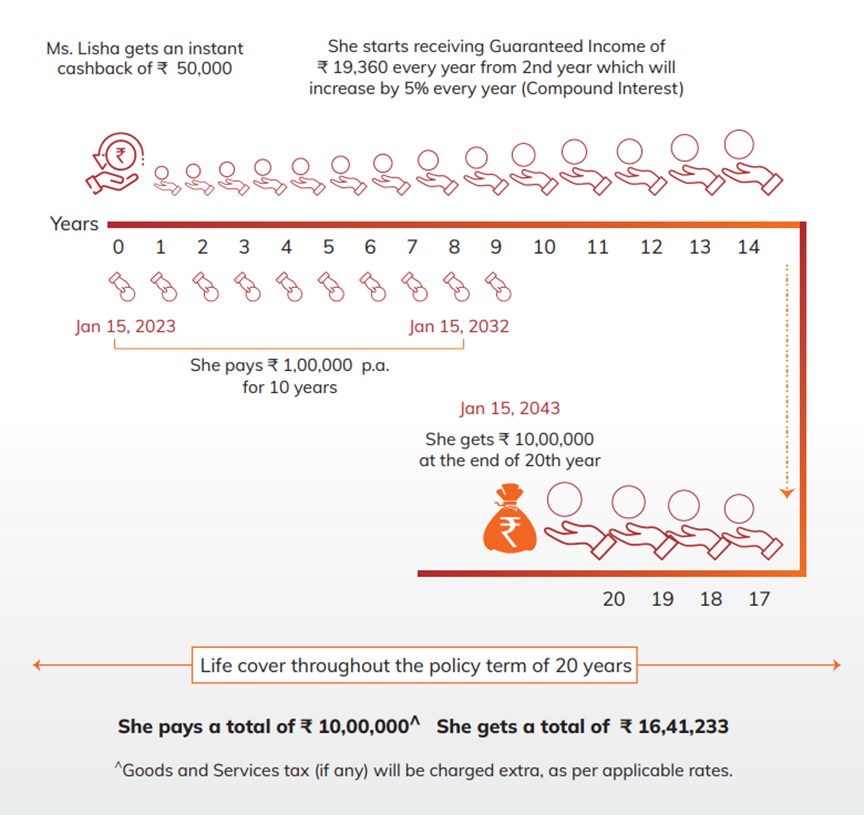

Ms. Lisha - a 35-year-old self-employed professional wants a secure source of supplementary income to meet her living needs.

She decides to pay an annual premium of ₹ 1 lakh in ICICI Pru GIFT Select where she starts receiving her income from the beginning of the 2nd policy year for an income period of 19 years. This includes an Instant CashBack Benefit for a policy term of 20 years and a 100% Guaranteed Maturity Benefit at the end of policy term.

She selects the Increasing Guaranteed Income option to ensure an increasing Income throughout the income tenure.

Death Benefit

If the person whose life is covered by this policy (known as the Life Assured) passes away, during the policy term, the Death Benefit will be paid as a lump sum to the person specified (known as the Claimant) in the policy.

The Death Benefit is highest of:

- Sum Assured on Death (defined as Death Benefit multiple X Annualised Premium)

- 105% of the total premiums paid up to the date of death, and

- Surrender value payable as of the date of death

Where,

- Annualised Premium means the premium amount payable in a policy year, excluding the taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any

- Total Premiums Paid means the total of all premiums paid under this policy, excluding any extra premiums, and taxes if collected explicitly

- In case Low Cover Income Booster (explained below in the section “Additional benefits”) is chosen, the Death benefit multiple is 7. If the Low Cover Income Booster is not chosen, the Death Benefit multiple is 10

Upon payment of the Death Benefit to the Claimant, the policy will terminate and all rights, benefits and interests under the policy will cease.

In the event of death of the Life Assured on the date of maturity, only the Maturity Benefit (if applicable) and the last GI payout (if applicable) will be payable, and the Death Benefit will not be payable.

For policies issued on a minor’s life, the date of commencement of risk will be the same as the date of commencement of the policy.

Flexibilities

1. Low Cover Income Booster:

Your financial needs may vary based on your age and life stage needs, where you may prefer either a higher income or a higher life cover. At the inception of the policy, you can choose the "Low Cover Income Booster" which allows you to enjoy additional income by opting for a lower life cover.

2. Flexi Save Option:

This feature offers you the flexibility to realign your benefits as per your changing needs. You have the option to accumulate the benefits instead of receiving them as payments during the policy term.

At any point during the Income Term, you have an option to defer the Guaranteed Income Benefit(s). The deferred Guaranteed Income payouts will earn a loyalty addition which shall accrues daily at the Reverse Repo Rate published by Reserve Bank of India (RBI).

Plan at a glance

| Premium Payment Term (in years) | Policy Term (in years) | Income Term (in years) | Minimum/ Maximum Age at Entry (in years) | Minimum/ Maximum Age at Maturity (in years) |

|---|---|---|---|---|

| 7 | 17 to 30 | Minimum: 1 year Maximum: Equal to policy term |

0/55 years | 18/75 year |

| 8 | 18 to 30 | |||

| 9 | 19 to 30 | |||

| 10 | 20 to 30 | |||

| 11 | ||||

| 12 |

- Minimum Annual Premium: ₹ 50,000

- Maximum Annual Premium: Subject to Board Approved Underwriting Policy (BAUP)

- Premium Payment Frequency: Annual, Half-Yearly, Monthly

- Minimum Sum Assured on Death: ₹ 3,50,000

- Maximum Sum Assured on Death: Subject to Board Approved Underwriting Policy (BAUP)

Goods and Services Tax are applicable on premiums as per the prevailing Tax Laws. The tax laws are subject to amendments from time to time.