Step 1 - Insurance Claim Reporting

The first step involves reporting your claims. You can report your claims online, at our branches or through an SMS as per your convenience.

Submit Online

Call ClaimCare

E-mail Claim or Send SMS

Please note that your claim will be formally registered, only after you provide us with a written request of claim settlement at our branch or Claims Cell office.

Step 2 - Insurance Claim Review

If you want to know the status of your claim, you can reach us through following touch points:

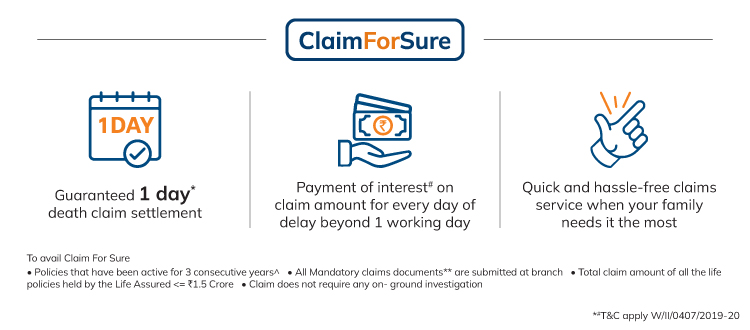

Step 3 -Insurance Claim Settlement

Once you have intimated us about your claim, and we receive all the relevant documents, we will settle your claim. Moreover, to secure your settlement amount, reduce documentation, and ensure your convenience, we use electronic modes of transfer for settling your claim.

We believe that a hassle-free claim settlement is the ultimate service we can provide to our customers.

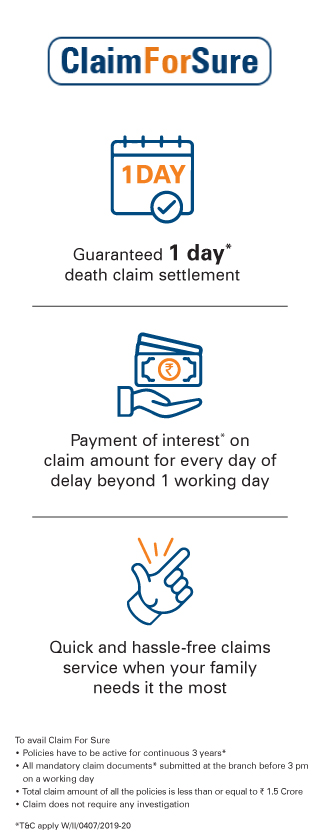

How much time does it take to settle a claim?

| Turn Around Time for death claim* | |

|---|---|

| Stages of claim | Turn around time |

| Settlement or Rejection or repudiation of claims where field verification is not required | Within 15 days from intimation |

| Settlement / Rejection / Repudiation of claims where field verification is required | Within 45 days from intimation |

*Turnaround time for claim processing and settlement will start only after receipt of all mandatory documents.

* 1 Day is a working day, counted from the date of receipt of all relevant documents from the claimant, additional information sought by the Company and any clarification received from the claimant. The Company will be calling the claimants for verification of information submitted by the Claimant which will also be considered as part of relevant documents. Working day will be counted as Monday to Friday and excluding National holidays /Bank holidays/Public holidays

# Interest shall be at the bank rate that is prevalent at the beginning of the financial year in which death claim has been received. In case of breach in regulatory turnaround time, interest will be paid as per IRDAI regulations

** Mandatory documents to be submitted at Branch Office- Claimant statement form, Original policy certificate, Copy of death certificate issued by local authority, AML KYC documents- Nominee’s recent photograph ,Copy of Nominee’s pan card, Nominee’s current address proof, photo identity proof, Cancelled cheque/ Copy of bank passbook, Copy of medico legal cause of death, Medical records (Admission notes, Discharge / Death summary, Test reports, etc.), For accidental death - Copy of FIR, Panchnama, Inquest report, Postmortem report, Driving license

^ All due premiums in the policy have been paid and the policy has been active for 3 consecutive years preceding life assured’s death

Under ULIP policies, if claim is submitted prior to 3 pm then the claim will be considered under Claim For Sure on the same day. If claim is submitted post 3pm or if the policy is inactive at the time of claim notification then the claim will be considered under Claim For Sure the next day as per availability of NAV

COMP/DOC/Jan/2023/271/2139

People like you also read ...

* Claim statistics are of FY2024 and is computed basis of individual claims settled over total individual claims for the financial year. For details, refer to public disclosures on our website

COMP/DOC/Aug/2018/38/1500.