| March 28, 2025 | 1-Month |

1-Year |

|

| Rupees per Dollar | 85.46 | 87.36 | 83.40 |

| Oil (dollars per barrel) | 73.63 | 71.62 | 87.48 |

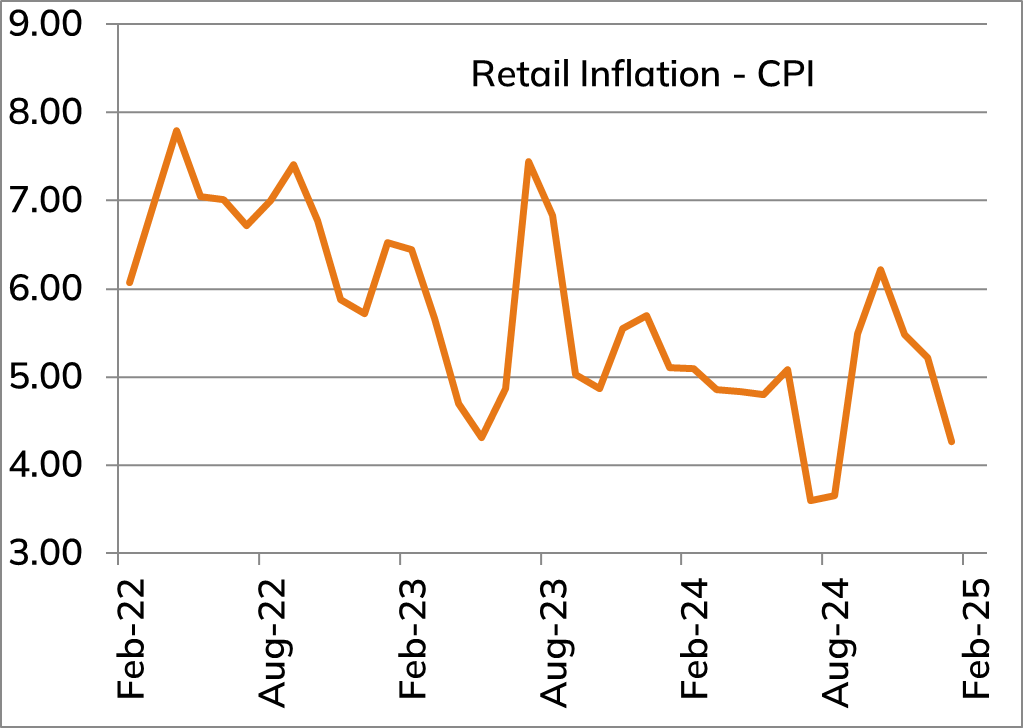

| Retail inflation (CPI) | 3.61% (Feb) | 4.26% | 5.09% |

- US Federal Reserve (Fed) is expected to keep the fed rate unchanged at 4.25%-4.50% during its March meeting. The probability of a US recession has increased and markets are pricing in 75 bps of rate cuts during 2025. European Central Bank (ECB) cut its policy rates by 25 bps to 2.50% and Bank of England (BoE) cut its policy rate by 25 bps to 4.50%

- RBI announced further Open Markets Operations (OMO) to purchase ₹ 800 billion of government securities in four tranches of ₹200 billion each

- The government announced the borrowing program for H1-FY2026 at 54% of its gross borrowings for the year (₹14.8 trillion). RBI also announced State Development Loans (SDL’s) borrowings at ₹2.73 trillion for Q1-FY2026

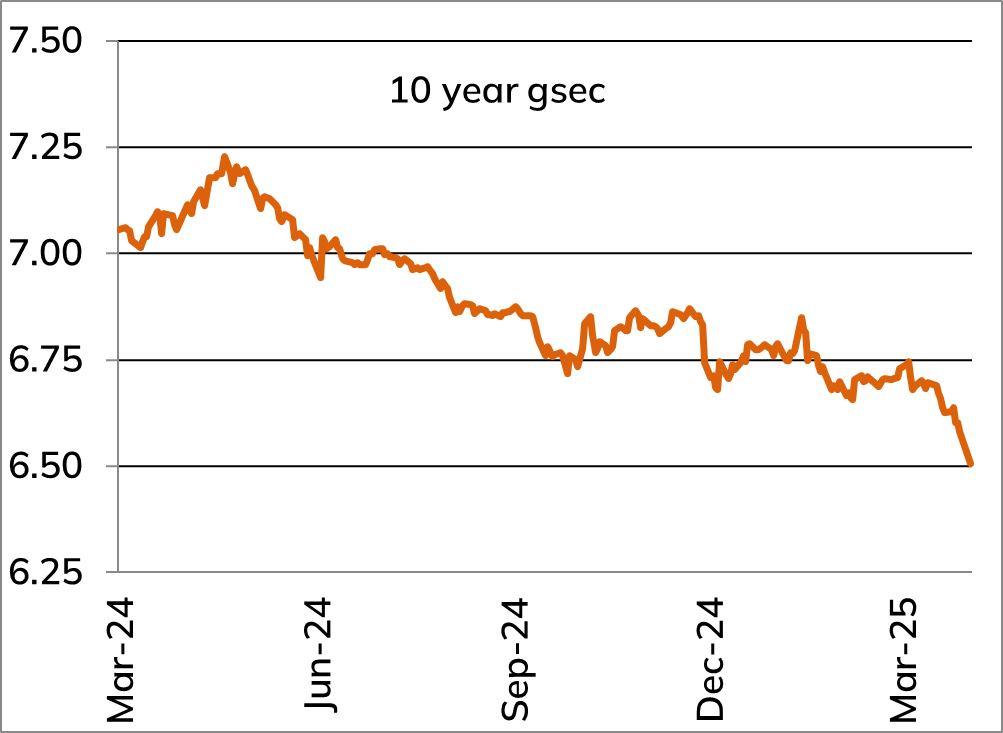

- We remain ‘neutral’ on the outlook for bond markets

- We expect the RBI to cut the repo rate by 25 bps

- The OMO’s and FX swaps undertaken by the RBI will ensure durable liquidity remains surplus going forward, which will be supportive for the short-medium term segment. We expect the 10 year G-sec yield to trade in a range of 6.40%-6.60% in the near term

- Market will be watchful of global developments and its impact on the exchange rate

| Index | 1 month (%) | 1 year (%) | 3 years (%) |

|---|---|---|---|

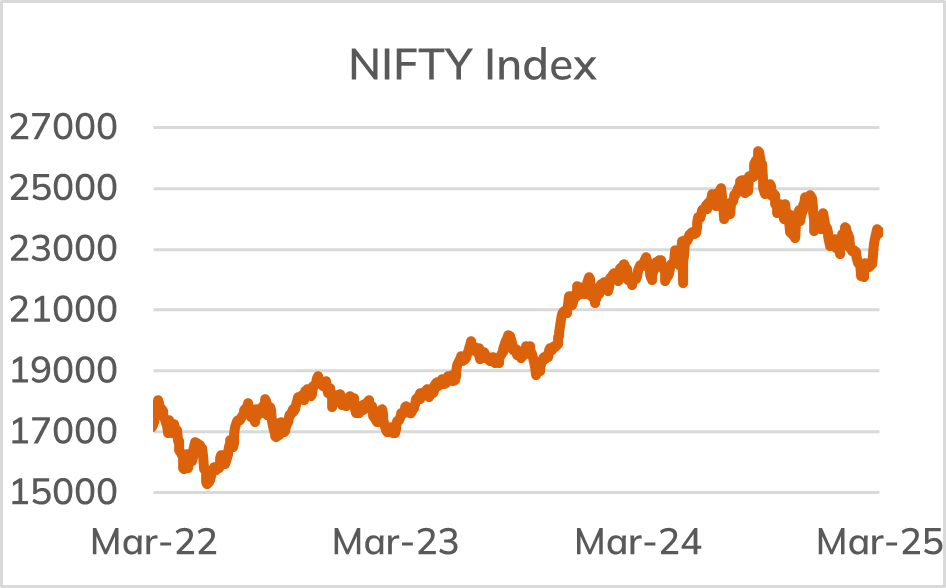

| NIFTY50 | 6.30 | 5.34 | 10.43 |

| BSE100 | 6.96 | 5.51 | 11.51 |

| NIFTY500 | 7.34 | 5.35 | 12.73 |

| NIFTY Midcap100 | 7.84 | 7.48 | 20.28 |

At March 31, 2025

Nifty was up 6.3 % for the month of March 2025

- After correction witnessed during the last few months, markets bounced back in March 2025

- FIIs turned buyers during March 2025 and DII flows continued to remain positive

- Within BSE 100 index, amongst sectors Finance/Bank outperformed while Capital Goods/Technology underperformed the broader market

Our outlook has changed to Neutral in the short term while the medium term remains positive

- Earnings growth has been weak during the last few quarters

- Uncertainty related to tariff wars and geopolitical risks could impact growth and capital flows in the near term

- However, with a more accommodative stance from RBI and measures undertaken by the government, we should see a gradual pick up in growth

- The Nifty’s P/E at 22x for FY2025E and 20x for FY2026E is trading near its 5-year average

- We have changed our short-term stance to Neutral with a bias towards large-caps

In the medium term, we expect certain important drivers for growth:

- India benefits from structural levers in the form of demographic benefits, rising formalisation, manufacturing focus and digitisation

- Corporate balance sheets remain strong which positions them well for the next leg of growth

- Earnings trajectory will be key monitorable over medium term

Market consensus for Nifty earnings CAGR over FY2025-FY2027 at 14%