| April 30, 2024 | 1-Month |

1-Year |

|

| Rupees per Dollar | 83.44 | 83.40 | 81.83 |

| Oil (dollars per barrel) | 87.86 | 87.48 | 79.54 |

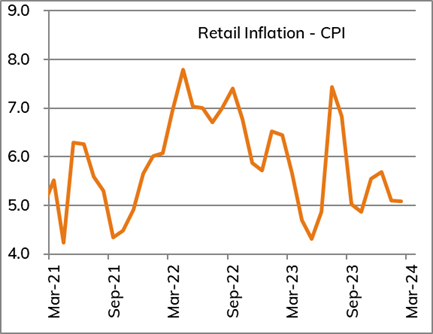

| Retail inflation (CPI) | 4.85% (Mar) | 5.09% | 5.66% |

- US Federal Reserve (Fed) left its policy rate unchanged at 5.25-5.50%. Macro data (both employment as well as inflation) was quite robust and has resulted in a sharp rise in US yields and drop in expectations of rate cuts by the Fed in 2024

- Global oil prices dropped from the highs of $91 / bbl during April to $84 / bbl on expectations of easing geopolitical tensions in the middle east

- The RBI Monetary Policy Committee (MPC) kept its policy rates unchanged at 6.50%. The overall tone was fairly balanced - continued comfort on growth, and emphasizing on bringing inflation to the medium-term target of 4% by ensuring disinflation on a sustained basis

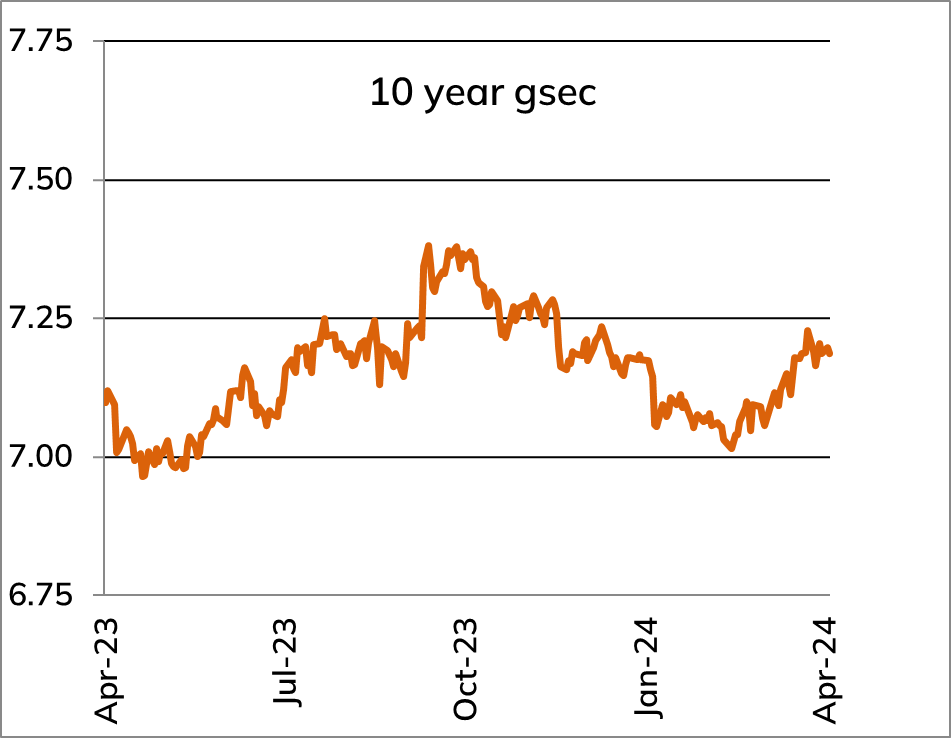

- We remain ‘neutral’ on the outlook for bond markets

- From the monetary policy perspective, paring of rate cut expectations by the Fed have increased the risk of a delayed easing by the RBI - we expect RBI to hold the policy rate at 6.50% at least until Q3 FY2025

- From a rates perspective, while the better demand supply dynamics and lower domestic inflation remains favorable for bonds, markets are likely to take further direction from the movements in US yields, crude oil prices and impact of heatwaves and monsoons on domestic food inflation

| Index | 1 month (%) | 1 year (%) | 3 years (%) |

|---|---|---|---|

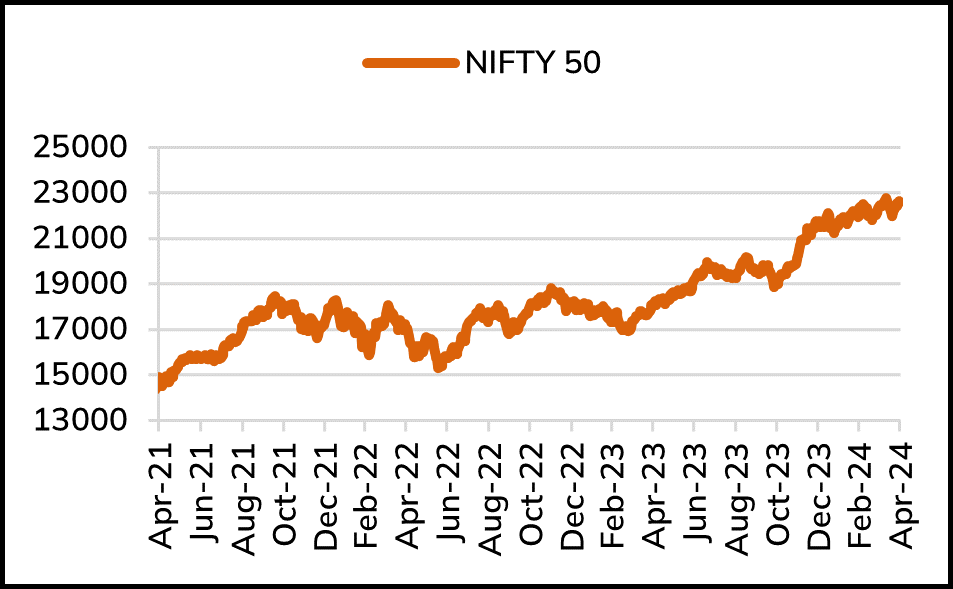

| NIFTY50 | 1.2 | 24.9 | 15.6 |

| BSE100 | 2.0 | 29.4 | 17.0 |

| NIFTY500 | 3.7 | 37.6 | 19.3 |

| NIFTY Midcap100 | 5.8 | 59.3 | 28.1 |

At April 30, 2024

Nifty was up 1.24% for the month of April 2024

- Markets continued with positive sentiment getting into the election season

- FIIs turned sellers during the month while DIIs continued to remain buyers

- Capital Goods/Telecom outperformed while Technology/EPC underperformed

Our outlook remains Neutral in the short term and Positive in the medium term.

- The broader India macro environment remains resilient; Q4FY2024 earnings have been broadly in line with expectations till now

- Markets appears to be pricing in policy continuity at the current juncture. RBI liquidity and domestic flows to be the key drivers for market performance

- We note that the Nifty P/E at 21x FY2025E is marginally higher as compared to 5 year mean

In the medium term, we expect certain important drivers for growth:

- India's long-term growth prospect remain robust given the uncertain global growth environment

- Rising corporate profitability as a share of GDP and improvement in Nifty returns ratios bode well for the growth

- India continues to benefit from demographic dividends, infrastructure development, reforms and digitisation